Dance of Darkness: Meme Stonk Section

---MEME STONK---

First, come to the sources for my absurd arguments:

Dark pool data glitch:

https://www.reddit.com/r/amcstock/comments/mcexii/citadel_and_others_have_over_2000000000_shares_of/

https://www.reddit.com/r/GME/comments/mcfq4e/shitadel_other_hedgies_are_trading_over_525/

GME Before Halts:

Beginning with the magnitude of 1 of these dark pools that "glitched" into existence; the TD dark pools. As you can see respectively for 4.6 bill synthetic shares (floats only 450 mil for AMC) and 630 mill synthetic shares for GME (float is 45.3 mill according to yahoo finance: https://finance.yahoo.com/quote/GME/key-statistics/).

As you can in the dark

pool specific data, this would roughly be 10.22x float in one dark pool for

AMC, and 13.91 x float for GME. Now recall, I said this list is important

right; https://link.springer.com/content/pdf/bbm%3A978-1-137-44957-3%2F1.pdf.

Moving forward I'd like to propose the idea that the TD dark pool may not be

the only dark pool with a similar float count (we will continue to use data

with sources going forward, to speculate), keep that question at the back of

your mind, we'll address it moving forward.

This section will go as

follows: i) relating memestonk and CDO dark pools ii) consequences of delaying

the squeeze and their financial war crimes, iii) Intent of Institutions going

long iv) there being more than one dark pool.

As stated; dark pools

are designed to hide institutional intent, lack transparency hide from the eye

of the authorities, retail investors, and the general public. This allows them

to manufacture synthetic shares in peace without having it be public knowledge

that the retail investor could track, as well the insurance companies (because

how dare you want market integrity and transparency right?). Once manufactured,

synthetic shares are taken from the dark pools and dumped on the open exchanges

through a naked short, then shorted driving the supply up and price down,

diluting the stock. They use dark pools to bypass their illegal naked shorting;

thus, dark pools lack transparency.

As such, memestonk dark

pools are not so dissimilar from the CDO and swap dark pools. Both are being

used to hide financial instruments that will change finances forever. As such,

if you hold shares of meme stocks, you hold insurance against the financial

landscape changing. As such the average ape, you heard me right, holds a swap

(Credit Default Swap; CDS). The shorts hold the CDO's. Similarly, I believe you

can expect a massive gain if you hold these meme stocks as insurance policies;

similar to 2008 (https://www.youtube.com/watch?v=3hG4X5iTK8M,

https://www.youtube.com/watch?v=II4Ct2n5FiE);

furthermore the media and the "sophisticated" investors are currently

laughing at you right now; the same way it happened in 2008 until housing

market collapsed, similarly you will have the last laugh when this

squeezes.

Now let us have a

checklist, between 2008 and now:

i) dark pools hold

crucial financial securities that will determine how the market will function:

check

ii) Media and

"sophisticated" investors are advising retail to invest in other

stocks other than meme stocks (CDS's): check

iii) Market at an all-time

high: Check

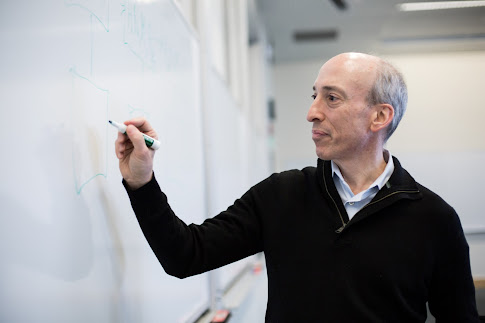

iv) Gary Gensler is

coming into clean the mess: Check

v) Banks and Hedge funds

are scrambling to get their finances in check to prepare for the financial

firestorm: Check

vi) The average person

believes everything is fine: Check

vii) Nobody is selling

either meme stock, and are in the process of doubling down (nobody sold their

CDS's too, and doubled down on synthetic CDO's): Check (https://capital.com/amc-entertainment-holdings-cl-a-share-price

, https://capital.com/gamestop-share-price)

vi) Institutions are

starting to view these stocks as insurance and are buying in: Check.

As shown, most factors

for a market change are here. Now let’s expand on how the GME squeeze before

the halts, and its relation to the current situation with dark pools, similarly

to when prices of the mortgage bond prices were increasing when the underlying

mortgages were failing; it was artificial, like the trading halts. As such here

are some screenshots, during the halts:

As shown without halts

GME would've jumped to 10k the next day, immediately forcing the shorts to

cover. Since the halts happened, a combo of synthetic shorting and dark pools

were used to tank the price, however, apes bought and held, so here we are.

Furthermore, if you

check the margin requirements for meme stocks:

ii) https://www.schwab.com/margin-updates

They’re up to 300% from

the usual 100%, which means it's really hard to borrow, meaning inevitably they

will squeeze. Combine this with the dark pools as elaborated, and the financial

illegalities that have been proven in this article, you can start to comprehend

the magnitude of their financial war crimes.

Addressing the intention

of institutions going long; I'll be honest, I think they're planning to wipe

out their competition completely like in 2008, last time Lehman Brothers, Bear

Stearns, Merrill Lynch, etc. went down; this time Citadel and other market

makers, while institutions that go long on these meme stocks will simply take

their wiped-out competitions market share and place. Finally, let us address

the final point of this section; remember that question, what if TD is not the

dark pool? well; based on these 2 sources:

i) https://link.springer.com/content/pdf/bbm%3A978-1-137-44957-3%2F1.pdf

ii) https://otctransparency.finra.org/otctransparency/AtsIssueData

(NMS Tier 2, January 25th moving forward (when it started)

In my speculative

opinion, the TD dark pools is guaranteed not to be the only dark pool. If all

dark pools that involve AMC have a synthetic share count of 4.6 bill or higher,

or even the 2 bill that Citadel holds, you could see how this could blow to

Olympus Mons (https://en.wikipedia.org/wiki/Olympus_Mons)

really really fast, and how screwed the shorts would be; hence the FUD.

Comments

Post a Comment