Dance of Darkness: The SEC and Darkpools (Original for Apes/Snyder Cut)

Dance

of Darkness: The SEC and Darkpools.

Hello everyone, thank you for your patience and for reading this thesis on darkpools and the SEC in advance. Firstly, let us note this is strictly not financial advice, this is just research I have compiled over weeks for entertainment purposes, this all-public information and is not intended to effect the price action of any stock in any shape, way or form.

The article will be divided into 3 major chunks, SEC

and the financial derivatives market, darkpools of credit swaps and synthetic

shares today, FUD dispersal and legal ramifications of naked shorting. My

motivation for writing this article was triggered by two conditions, the

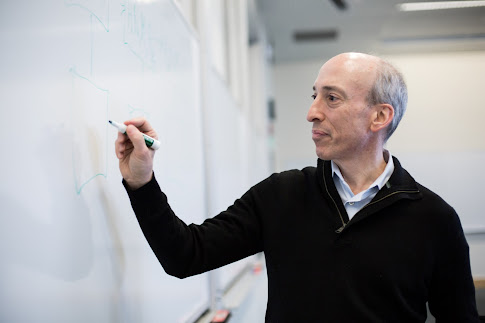

ongoing process of appointing Gary Gensler as the SEC chairman, and the

revelation of the existence of massive darkpool trading certain meme stocks, in

an effort, to bamboozle the retail investor.

---THE SEC SECTION---

Gary Gensler, the former chairman of the CTFC

(Commodities Trading Futures Commission) is currently in the process of being

appointed the SEC chairman. Currently, the senate banking committee has

approved Gensler at a 14-10 vote (https://www.investmentnews.com/senate-banking-committee-approves-gensler-nomination-203813 ,

https://www.c-span.org/video/?509429-1/sec-chair-cfpb-director-confirmation-hearing ),

and he will be voted on by the senate proper in a weeks time on April 12th (https://www.thinkadvisor.com/2021/03/31/schwab-expects-activist-sec-under-gensler-senate-sets-confirmation-vote-date/ ).

He is expected to have bipartisan support and be sworn in as the new SEC

chairman. Gary Gensler is extraordinarily hated by Wall Street for a couple of

reasons, the main reason is he is a hardnosed regulator interested in the

transparency of the market place and democratizing market place information in

favor of the little guy (https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection ).

This fundamentally goes against the closed country club nature of Wall Street;

this was shown by the enforcement of the Dodd-Frank act (https://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consumer_Protection_Act

, https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

).

So let us elaborate what happened; let us take a trip

back memory lane the last time Wall Street made a grievous market error 2008.

In order to fully explore this memory, we must take a side journey through the

paths, to the financial derivatives market and credit default swaps (https://www.investopedia.com/ask/answers/052715/how-big-derivatives-market.asp

, https://www.investopedia.com/terms/d/derivative.asp

). The financial derivatives market, specifically futures, we're designed by

markets to allow farmers, ranchers, manufacturers, industrialists, producers

etc., to lock in prices and mitigate risk in the production and operation of

businesses. As such, the core of what these markets are about is to lock in

prices for commodities and to manage risk; by allowing investors to lock in

prices or rates and thereby manage risk and volatility. As such, the

derivatives market is quite essential to the supply management side of the real

economy (the part of the economy where you and I work in), as such any

meltdowns in the derivatives market can and in 2008 had spilt over to the real

market. As such, combined these markets are very very large, estimated at 640

trillion dollars (https://www.investopedia.com/ask/answers/052715/how-big-derivatives-market.asp ),

in market capitalization, and according to Gary Gensler that represents roughly

22 dollars of hedging for every dollar exchanged in the real economy (https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection );

he did say that specific figure in 2010 though, so it maybe way higher right

now. As such futures and swaps are invested in almost every aspect of our lives

(food, fuel, mortgages, credit rates, interest rates, etc.). As such, given the

importance of the derivatives market, it is imperative it stay transparent and

competitive; this was not the case in 2008.

This was due to two things being in play in 2008,

darkpools and credit default swaps, specifically CDSs insuring against CDOs

composed of mortgage bonds collapsing. This was due to the underlying assets

(mortgages) defaulting at a rapid rate, causing the collapse of the bonds,

causing the CDOs composed of the bonds to collapse/default in price; causing

the CDSs to kick in and insure against the original value of the bond upon

inception of the CDSs. This transaction occurred, you guessed it, in darkpools.

We shall cover darkpools in high depth and breadth in a short while so bear

with me; before I go down further down the path of memory lane, let me explain

the terms I stated forward and quickly go over the darkpools, and what Gary

Gensler's response to this was.

As such lets start with CDOs; collateralized debt

obligations, think of these as financial products composed of multiple other

financial products backed by assets like bonds, collateralized loans etc. (https://www.investopedia.com/terms/c/cdo.asp#:~:text=A%20collateralized%20debt%20obligation%20(CDO)%20is%20a%20complex%20structured%20finance,derived%20from%20another%20underlying%20asset

., https://www.investopedia.com/terms/c/cdo.asp#:~:text=A%20collateralized%20debt%20obligation%20(CDO)%20is%20a%20complex%20structured%20finance,derived%20from%20another%20underlying%20asset .).

CDS: Credit Default Swap; in short, it's insurance

against a value of a security in case it's value drops. How this works is, you

take out a policy against a security, and pay somebody else to take the risk of

its valuation falling. This risk is taken off your shoulders, by you paying the

other party a premium to maintain the insurance policy (i.e. you hedge against

your securities dropping in value). As such the value of the security you are

insuring is safe, if you keep up your premium payments, insuring you against

risk. Furthermore, if you choose to exercise your insurance, as the value of

the security falls, you are paid out your insured amount; if the value of the

security increases and you choose to close out/exercise, you will take that

loss + premiums. (https://www.investopedia.com/terms/c/creditdefaultswap.asp#:~:text=A%20credit%20default%20swap%20(CDS)%20is%20a%20financial%20derivative%20or,with%20that%20of%20another%20investor.&text=To%20swap%20the%20risk%20of,the%20case%20the%20borrower%20defaults .)

Darkpools: Darkpools are exchange forums that

replicate open stock exchanges, closed off to the public designed to hide

institutional trading intent. In other words, by Gary Gensler himself,

darkpools are designed to lack regulation, transparency and the light of transparency

must be shone upon them (https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection ,

https://www.investopedia.com/terms/d/dark-pool.asp ).

Now that I believe everything has been established let

us quickly reiterate the chain of events in 2008, and Gary Gensler's response

as the CFTC chairman; and how he dealt with darkpools before (meme stock

synthetic shares are in darkpools I would speculate).

So let us begin, Banks relax loan requirements to make

cash of interest and mortgages-> package those into bonds --> package

those into CDO's --> market them as great investment, while the underlying

bonds are absolute garbage (this became garbage around 2006) --> Michael

Burry and co notice this and take CDS on them --> wait 2 years, 08 roles

around --> the market corrects itself violently where CDS's are basically used

to wipe out mortgage CDO's; these transactions occur in darkpools, away from

the public eye; all the while like right now the media say everything is

absolutely fine, you should totally hold onto your mortgage and get it

refinanced (sell your meme stocks today, squeeze is definitely over, you should

totally believe us).

As such in short, the unregulated swaps market spilt over into the real economy and exposed everyday Americans to real risk (with meme stocks its reversed, the shorter are at real risk right now).

In comes in, Gary Gensler and the Dodd-Frank act

Due to the crash, the Dodd-Frank act was designed to

curb excessive market abuses and speculation due to the lack of transparency

due to darkpools. As such it had 3 main goals according to the to be SEC

chairman (https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection ,

https://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consumer_Protection_Act ,

https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp ):

i) Bring Transparency and competition to swap

darkpools

ii) Lower risk

iii) Increase market integrity

As such, according to Gary Gensler 90% of unregulated

swaps and futures were brought in from darkpools and mandated to use clearing

houses, so position data could be marked real time for the public to view.

Furthermore, the Dodd-Frank act established several

other protections (https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp ),

these are as follows:

i) Protections against the formation of too big to

fail institutions (so citadel can fail, and everybody will be fine

hypothetically), as a failure of any one of them could negatively affect the US

economy.

ii) The Consumer Financial Protection Bureau (CFPB),

established under Dodd-Frank also worked to curb predatory mortgage lending, deterring

high commission mortgage brokers from closing high interest loans with high

fee's; stopping the feedback loop of bad loans being dished out in exchange for

high commissions, fees and interest. It also protects consumers from excessive

credit and debit card fees and interest, by my understanding (https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf )

iii) Volcker Rule: It restricts banks investing in

speculative trading and eliminates proprietary trading

(https://www.investopedia.com/terms/p/proprietarytrading.asp); furthermore

Banks are not allowed to be involved with hedge funds or private equity firms

considered to be too risky; lastly in an effort to minimize possible conflicts

of interest, financial firms aren't allowed to trade proprietarily without

sufficient "skin in game" (https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp ).

Furthermore, the Volcker Rule: "regulates financial firms' use of

derivatives to prevent "too big to fail" institutions from taking

large risks that might wreak havoc on the broader economy" (Citadel maybe

intimately familiar with this).

iv) Whistle-blower Program: The Dodd-Frank act also

goes ahead and strengthened and expanded the whistleblower program. As such it

specifically established a mandatory bounty program (you heard that right, if

you hunt down a shill spreading "insider information", that alludes

to collusion or any other illegal activities, you get a big fat reward). I'll

let the text from Investopedia take this one here:

"Specifically, it established a mandatory bounty

program under which whistleblowers can receive from 10% to 30% of the proceeds

from a litigation settlement, broadened the scope of a covered employee by

including employees of a company's subsidiaries and affiliates and extended the

statute of limitations under which whistleblowers can bring forward a claim

against their employer from 90 to 180 days after a violation is

discovered"

Meaning, you as a whistleblower can receive up to 30%

of the litigation settlement amount, if you can provide concrete evidence of

collusion (we'll expand on naked short fines in a bit after the in-depth dive

through darkpools as promised.); so if you have proven insider information,

happy hunting:

Lastly, to end this section I'll leave the actual

Dodd-Frank act here in case any legal scholars are reading this and would like

to dissect this: https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf .

Now going back to the man who enforced this and

brought the banks and other bad financial actors under control the last time by

busting these darkpools, Gary Gensler. If Gary Gensler is appointed, and if

these hedgefunds have their short positions in darkpools to dupe the consumer;

they will not only be breaking a litany of federal financial regulation laws. Furthermore,

the SEC, DTTC, and hedgefunds/institutions long on meme stocks (Blackrock) have

already started swimming around sensing blood in the water, once Gary Gensler

comes in, based on his previous behavior of effectively curb stomping illegal

actors into submission, I can see him litigating Citadel and co (if they are

guilty) out of existence and forcing them to close, like he did last time as

the Future's chairman.

*Recap for Apes*

So let us recap, swaps and darkpools we're used in

2008 to insure against the financial collapse created by the greed of financial

institutions. The reason why we haven't had an exact repeat of 2008 is because

of the Dodd-Frank act; and the enforcer that took out Wall Street Gary Gensler,

is going to be running the SEC during meme stock chaos; which means the shorts

loose their friends in high places that haven't been enforcing the rules.

From here on we shall take a deep dive into how

darkpools work, then talk about the hypothetical legal implications of shorter

being caught with illegal naked shorts in darkpools; so, let us begin.

---DARKPOOL SECTION FOR APES---

So, let's begin with the darkpool definition in layman

terms; darkpools in essence are exchanges off of exchanges. A growing problem

that brokers and retail investors noticed is that if a lot of small-scale

orders are going through a relatively large and complicated fee system, for

instance with the NYSE (https://www.nyse.com/publicdocs/nyse/markets/nyse/NYSE_Price_List.pdf ).

This is detrimental to both retail trading due to the

convoluted pricing model as well as the broker-dealers that can, if they

reached a certain threshold of clients, could mostly trade internally between

clients anyway. Morgan Stanley (https://www.morganstanley.com/disclosures/morgan-stanley-dark-pools ),

Goldman Sachs (https://www.thetradenews.com/guide/goldman-sachs-sigma-x/ )

and of course Citadel (https://www.reuters.com/article/us-citadel-darkpool-idUSKBN0MN22Q20150327 ,

closed in 2015 after harsher reporting requirements, go figure) all run darkpools

just for that purpose.

This, in turn, adds a sort of "buffer" in

front of the exchanges, once enough shares are circulating in the darkpools any

buy and sell order can be fulfilled to 100% outside of the exchange during

normal trading activity.

But as with any buffer, if you know how to play the

system, it can be abused as an amplifier. If you were a hedgefund that wants to

make a quick profit off shorting a stock, you lend as many shares as possible,

dump them on the exchange and watch all the retail investors trying to

"cut their losses" while you phone up CNBC or Fox Business to spread

the news of falling prices (opinion pieces, and opinion = speculation) to even

the last boomer to get them to sell. Once you start to see a decrease in

volatility after "smart" retail traders start buying shares, you try

to cover your short position in the darkpools. This allows you, as every retail

investor is looking at the exchange charts, to buy up shares on a downward

momentum without influencing the chart price (immediately). This obviously

works vice versa if you have a long position and want to dump it at a profit.

Drive up the exchange price, sell off in the darkpools. Cramer admitted to part

of the process in an interview (https://www.youtube.com/watch?v=jIfixbq_u0Q ),

on the darkpools, while not mentioned, it is certainly part of the process.

An illustrate how this might work in an example:

Company A wants to acquire company B ASAP by buying up

let's say 30% of shares of company B. Company A therefor goes to market maker M

to buy shares for them. M then proceeds to start buying shares on the exchange

to drive the price up a bit.

Meanwhile they try to buy up as many shares from the

darkpools as possible, in order to not drive the price up on the open exchange.

The price on the exchange usually reflects in the darkpools, but not vice versa

(because people look at the exchange prices, shortages in darkpools only show after

a slight delay).

If you were to say that a purchase of 5% of the float

would drive up the price of shares from B up by 5%, that would mean that after

the buy the price would be 30% higher with around 15% higher than start price

average.

That is if people were not to start day trading the

shares, which probably will happen.

However: if you were to do the same thing with

darkpools you suddenly see that while the price on the exchange goes up, M is suddenly

able to buy shares from places that do not influence the share price.

Again, 5% purchase on the open market equals 5% price increase. If 10% can be covered over the darkpools, only 20% affect share price, leaving us with an average of about 10% higher than starting price.

This is 5% that was "saved" for M and A. M obviously wants a small fee for the service totaling 2%, that leaves A with around 3% saved; that 5% came from the retail investor that was not aware of the movements in the darkpools. It costs the retail investor money. It robs you of your 30% gain in that scenario and gives you 20% instead. It costs you.

Now, remember how Cramer said that researching sentiment is key in order to pull that stunt off (https://www.youtube.com/watch?v=r07Gg92YjOI )? Well, wouldn't it be easier to pay brokerages as a hedgefund to process their order flow? That way you can not only instantly know the sentiment without any bias, but also take the opposite side of a trade by going short, thereby negating any buying pressure, be it dark pool or exchange or even direct to a limited degree where the order gets executed. This, in conjunction with a possible delay in order execution to arbitrage money (https://youtu.be/RNgzOr-m6ok?t=89 ), has been somewhat discussed in the congressional hearings. This in all essentialities is a (albeit slow) money printer that Citadel created for themselves; that we can confidently speculate exists.

Not only that, but if Citadel believes that your decision

to buy a stock is stupid, they could take the other side of the trade by

shorting it and giving you the shorted share

This is where Citadel (they're the largest market

maker) and CFD trading comes in:

By going through darkpools, Citadel as a market maker could in theory capitalize on such scenarios massively; furthermore until 2015 they ran their own darkpool, called Apogee (https://www.iotafinance.com/en/Detail-view-MIC-code-CDED.html ) which was decommissioned in 2015 possibly due to increased reporting/transparency requirements (https://www.reuters.com/article/us-citadel-darkpool-idUSKBN0MN22Q20150327 ).

However, by operating one of the most successful darkpools called Apogee, Citadel as a market maker was able to capitalize on such scenarios massively. Since then, Citadel switched to Citadel Connect, which does not qualify as an alternative trading system and therefore does not need to report.

But what are the implications if we suddenly have a relatively large trading platform that is owned by a market maker? Said market maker can 1. get real time data about (retail) sentiment and 2. can decide to take the other side of the trade; just like stated earlier.

Best case scenario for Citadel, if they wanted to short a stock would be to not have shares involved at all or making a contract for difference with you; this means you make an agreement with Citadel to get the current share price at any time you like from them, without ever having to buy or sell the shares.

This kind of trading is heavily regulated however, and therefore not really that common, especially seeing how it's mostly speculative anyway. They do have a way to engage in a similar tactic however: naked shorting.

As we all know, under Reg SHO 203 b 2 iii (https://www.law.cornell.edu/cfr/text/17/242.203 )

market makers are allowed to short a security under a bona fide agreement,

meaning without ill intend. As if that would have stopped anyone before, the

worst is a slap on the wrist by SEC (before Gary Gensler), the best is massive

tax-free profits.

So, what they do is naked short the stock by pretending

to act in good faith, aka buying naked calls from another party that they

control, here "Citadel LLC" (the hedgefund part). After that they can

lend the equivalent amount of shares out to either "Citadel LLC" or

any other party, which then dump them on the open market. This however breaks

after 3 days, since the "shares" that were put on the exchange never

existed, therefore becoming FTDs. Once the FTD status is reached after X number

of days, they simply go to their "Robinhood" buddies (or whatever

other party, can be a shell company) and ask them to write ITM call options,

excersie them and replace their FTD-IOUs with ones from Robinhood. Once these

reach their FTD status they do that in reverse, with Citadel's IOUs replacing

those of Robinhood. Repeat ad infinitum and you can crash a stock price by

printing shares faster than the federal reserve can print dollars. If

institutions (inevitably) bail out, only retail remains. And if retail does not

have a collective opinion on certain securities, we see a run by retail to get

rid of the bag.

Now what I've said may sound despairing and should get

you angry, however I believe this cycle has almost been crushed, due to apes

buying and holding. Allow me to present to you this diagram:

In this diagram you can see how, they can use

synthetic share production mechanisms, blatantly creating synthetic shares in a

darkpool as market maker (citadel runs it), making phantom shares using calls,

Failure to Delivers, explicit naked shorting (creating IOU's), etc. (there's

tons of illegal production mechanisms, most of which we're covered in my old

DD's and a quick recap example above). Once they've determined which method

they'll use, they target the security, and the flow chart begins. If they use

the darkpools, they can theoretically create an infinite amount of synthetic

shares (they'd have to buy infinite real shares to buy though to cover though

if their a) caught with synthetics or b) get margin called).

As apes have been effectively been buying up all

synthetics and creating price floors as you've seen, a hedgefund at this point

has 2 choices; cover all the shares (the smart choice), or digging themselves

in the hole deeper hoping you will sell creating FUD (reddit/discord

infiltration will tell you when their getting desperate); so they can finally

cover, as such if investors keep buying and holding, either more rocket fuel

gets added to the rocket or they cover; either or, doesn't matter what anybody

else says.

Lastly here's a list of darkpools that I found that

have existed in "the state of play", back in 2014, I apologize I

couldn't find anymore recent data:

https://link.springer.com/content/pdf/bbm%3A978-1-137-44957-3%2F1.pdf (I WOULD HIGHLY RECOMMEND GOING THROUGH THE

DARKPOOLS); (FYI Goldmansachs has one, and they just got margin called for

context: https://www.youtube.com/watch?v=mP4yaoQll7I (if your r/wsb YouTube links aren't allowed

for sources sorry) due to Bill Hwang)

*Recap for Apes*

Now lets recap, what we've discussed in the; SEC

chairman Gary Gensler is well versed in bringing swaps out of darkpools which

caused the last crash and is coming in during the point of the SEC during a

speculative short squeeze that will top all other short squeezes in human history

(in my speculative opinion), This may cause the greatest wealth transfer in

history.

The elites from any society would not like this as it

would mean, their status would be tarnished; as such they will resort to any

amount of financial war crimes to try to make sure that doesn't happen. However,

during the last financial war (2008), the good man Gary Gensler came in and

enforced the rules congress passed, this time he's coming in again. I believe

he will enforce the rules and bring justice to these financial war crimes again

as shown by his record; as such before that happens you will see FUD

intensifying (which is already happening, expect more of this); as such if

you've been in the game this long, you should know the drill by now.

---LEGALITIES FOR APES---

Before we full relate this to our meme stocks, let's

talk legal for a bit; if Citadel as a market maker is using order flow,

darkpools, and synthetic shares to balloon to the height of being to big to

fail, they violate a half dozen federal laws and policies, targeting you the

consumer. So lets go over them (I'm a physicist by training not legal expert so

I'll link the laws and tell you guys my speculation and let legal experts

handle it):

Firstly, let me put the sources on naked shorting and

counterfeit/synthetic shares first:

https://www.investopedia.com/terms/n/nakedshorting.asp

http://counterfeitingstock.com/CS2.0/CounterfeitingStock.html (I WOULD REALLY RECOMMEND READING THIS)

The Dodd-Frank act:

https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf

Naked shorting fines:

http://www.businesskorea.co.kr/news/articleView.html?idxno=26998

https://www.sec.gov/about/offices/ocie/options-trading-risk-alert.pdf

https://www.sec.gov/alj/aljdec/2013/id490bpm.pdf

https://www.sec.gov/litigation/admin/2010/34-62025.pdf

SHO rule:

https://www.law.cornell.edu/cfr/text/17/part-242

https://www.law.cornell.edu/cfr/text/17/242.203

Anti-collusion and market manipulation laws:

https://www.investopedia.com/terms/c/collusion.asp

https://www.sec.gov/files/Market%20Manipulations%20and%20Case%20Studies.pdf

https://www.mcgill.ca/iasl/files/iasl/aspl614-competition_and_antitrust-laws.pdf

Possible conflicts of interest using Orderflow

payment:

https://www.sec.gov/rules/final/orderfin.txt

Insider trading laws:

https://www.sec.gov/Archives/edgar/data/25743/000138713113000737/ex14_02.htm

https://www.seclaw.com/insider-trading/

So as stated above, I am no legal expert; however, I

will tell you of my understanding of them based on the sources I have read, any

legal expert reading this is; feel free to correct me and post them in the

comment section below (I want a specific rebuttal based on the legal text

though, your co-operation is appreciated).

If a market maker like Citadel, or any other firm that

has shorted meme stocks, utilizing darkpools, collusion and synthetic shares to

try and dupe retail investors that simply "like the stock" and are

buying and holding, by my understanding they violate:

i) Anti-collusion and market manipulation laws: By

working together with other institutions they are colluding and manipulating

the price, that simple.

ii) Naked shorting: Borrowing a security that doesn't

exist to shorting is straight up illegal, and if you are caught using naked

shorts the fines can range from $5,128 - $14,887 (USD) per naked short (sources

are given in the naked shorting section).

iii) Synthetic share creation: This in my opinion

would qualify as a naked short and market manipulation; as not only are you

shorting a share that doesn't exist, you are manipulating the market so the

price goes down by diluting supply, also illegal.

iv) SHO rule violations: From the SEC: Regulation SHO

requires broker-dealers to identify a source of borrowable stock before

executing a short sale in any equity security with the goal of reducing the

number of situations where stock is unavailable for settlement (https://www.sec.gov/investor/pubs/regsho.htm#:~:text=Regulation%20SHO%20requires%20broker%2Ddealers,stock%20is%20unavailable%20for%20settlement );

as such if a broker-dealer cannot identify the source of a stock, before a

short sale, its illegal.

v) Dodd-Frank act violations: If Hedgefunds are found

colluding with each other to rig the market using short shares to become too

big to fail, that violates the Dodd-Frank act as it is explicitly designed to stop

according to you guess it Gary Gensler the new incoming SEC chairman (https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection ).

vi) Insider Trading Laws: Trading based on non-public

information; in my opinion this is blatantly illegal as such the debate is black

and white; thus illegal.

vii) Order flow payment: The SEC, and Congress are

currently debating whether order flow payment is legal in the first place; we

shall see what conclusion they come to.

Lastly, this is all I've found so far, but if you find

anymore illegalities please go ahead and comment down below.

As such, let's wrap up these financial war crimes

(their war crimes, because they are explicitly designed to hurt the innocent;

retail investors). Thus, if Citadel is using synthetic shares to make itself

too big to fail hypothetically would constitute as basically a massive

financial war crime, as it would break anti-collusion, the Dodd-Frank act,

prohibition against naked shorting, SHO rules, prohibition of Market

manipulation, insider trading, etc. (lawyers have at it); as such if they are

caught would be facing legal and financial extinction (of course this is just

speculation by a dude on the internet, confirm it for yourself; if this is true

however and can be proven in court, I believe it can be constituted as a

financial war crime and should be dealt with accordingly). Furthermore if you

have insider information proving this, you by the Dodd-Frank act's

whistleblower program are entitled to up to 30% of the settlement amount, so

happy hunting apes (https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp ).

If you are reading this on r/wallstreetbets (if this

gets on there) this is as far as I can go without it violating the new rules,

due to the sub-reddit's size; as such I will leave with you a thanks for

reading my work, and further sources to backup my argumentation.

List of sources (apologies if some of these sources

we're already used in the article, but I needed to be transparent and

thorough):

https://www.investopedia.com/terms/d/dodd-frank-financial-regulatory-reform-bill.asp

https://www.c-span.org/video/?509429-1/sec-chair-cfpb-director-confirmation-hearing

https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection

https://en.wikipedia.org/wiki/Office_of_Thrift_Supervision

https://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consumer_Protection_Act

https://www.investopedia.com/terms/l/libor.asp

https://www.bbc.com/news/av/business-21532735

https://en.wikipedia.org/wiki/Gary_Gensler

https://www.pionline.com/washington/gary-gensler-cleared-senate-confirmation-sec-chairman

https://www.forbes.com/advisor/investing/gary-gensler-sec-chairman/

https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection

https://www.c-span.org/video/?509429-1/sec-chair-cfpb-director-confirmation-hearing

https://en.wikipedia.org/wiki/Dodd%E2%80%93Frank_Wall_Street_Reform_and_Consumer_Protection_Act

https://www.investopedia.com/terms/l/libor.asp

https://www.bbc.com/news/av/business-21532735

https://en.wikipedia.org/wiki/Gary_Gensler

https://www.pionline.com/washington/gary-gensler-cleared-senate-confirmation-sec-chairman

https://www.forbes.com/advisor/investing/gary-gensler-sec-chairman/

https://www.c-span.org/video/?304711-1/financial-regulations-consumer-protection

https://www.dtcc.com/legal/sec-rule-filings

https://www.investopedia.com/terms/o/otcqx.asp

https://www.investopedia.com/terms/o/otcqb.asp

https://www.investopedia.com/terms/o/otc-pink.asp

https://www.warriortrading.com/top-3-risks-trading-otc-markets/

https://www.sec.gov/news/statement/shedding-light-on-dark-pools.html

https://www.investopedia.com/terms/n/nakedshorting.asp

https://www.investopedia.com/terms/d/dark_pool_liquidity.asp

https://www.imanet.org/-/media/4c6c7650a0024853a1c61963d7865649.a

https://www.investopedia.com/articles/optioninvestor/08/synthetic-options.asp

https://www.law.cornell.edu/cfr/text/17/part-242

https://www.law.cornell.edu/cfr/text/17/242.203

Thank you for your attention, and I hope you have a

wonderful day; none of this was financial advice, and purely opinion based on

the sources given for entertainment purposes. Lastly, I am not a cat, and like

the stock.

Now if you are still here, this is for sub-reddits

other than r/wsb. We will now briefly talk about the evidence for darkpools

being used for both meme stocks GME and AMC; and why the shorts want you to

sell so so badly. Let us begin:

---MEME STONK SECTION---

First come the sources for my absurd arguments:

https://www.reddit.com/r/amcstock/comments/mcexii/citadel_and_others_have_over_2000000000_shares_of/

https://www.reddit.com/r/GME/comments/mcfq4e/shitadel_other_hedgies_are_trading_over_525/

https://www.schwab.com/margin-updates

So let us begin with what the magnitude of 1 of these

darkpools that "glitched" into existence; the TD darkpools. As you

can see respectively for 4.6 bill synthetic shares (floats only 450 mill for

amc) and 630 mill synthetic shares for GME (float is 45.3 mill according to

yahoo finance: https://finance.yahoo.com/quote/GME/key-statistics/ ).

Darkpool specific "glitch" data:

https://www.reddit.com/r/amcstock/comments/mcexii/citadel_and_others_have_over_2000000000_shares_of/

https://www.reddit.com/r/GME/comments/mcfq4e/shitadel_other_hedgies_are_trading_over_525/

As you can see this would roughly be 10.22x float in

one dark pool for AMC, and 13.91 x float for GME. Now recall, I said this list

is important right; https://link.springer.com/content/pdf/bbm%3A978-1-137-44957-3%2F1.pdf .

Moving forward I'd like to propose the idea that the TD darkpool may not be the

only darkpool with a similar float count (we will continue to use data with

sources going forward, to speculate), keep that question at the back of your

mind, we'll address it moving forward.

From here we will focus on relating meme stock darkpools to the similarities, the current scenario. Furthermore, we will explore the possibilities of meme stocks without halts, and why a further delay would cause a larger squeeze than the one already scheduled in as an inevitability. So let me reiterate you apes, we'll go over 08 and meme stock darkpools, show how the magnitude of their financial war crimes, intentions of institutes going long, and then go over the hypothetical scenario of that TD dark pool not being the only darkpool with synthetic meme stonk shares in them; let us begin.

So as stated in the prior sections, these darkpools are designed to hide institutional intent, lack transparency and are being used to get away from the eye of the authorities, retail investor and general public. This allows them to manufacture synthetic shares in peace without having it be public knowledge that the retail investor could track, as well the insurance companies (because how dare you want market integrity and transparency right?). With the synthetic shares from lets say the TD dark pool being manufactured, can go 2 be dumped on to exchanges; through a naked, then shorted driving the supply up and price down, diluting the stock. Sounds simple enough, so they just use darkpools do bypass their illegality naked shorting, as darkpools lack transparency.

As such these memestonk darkpools are not so dissimilar

from the darkpools that held CDO's and their corresponding swaps. Both are

being used to hide financial instruments that will inevitably cause the

financial landscape to change forever. As such, if you hold shares of meme

stocks, you hold insurance against the financial landscape change; the average

ape, you heard me right, holds a swap (Credit Default Swap; CDS). And the

shorts hold the CDO's. Similarly, I believe you can expect a massive gain if

you hold these meme stocks as insurance policies; similar to 2008 (https://www.youtube.com/watch?v=3hG4X5iTK8M ,

https://www.youtube.com/watch?v=II4Ct2n5FiE );

furthermore the media and the "sophisticated" investors are currently

laughing at you right now; the same way it happened in 2008 until housing

market collapsed, similarly you will have the last laugh when this squeezes.

Now let us have a check list, between 2008 and now:

i) Darkpools hold crucial financial securities that

will determine how the market will function: check

ii) Media and "sophisticated" investors are

advising retail to invest in other stocks other than meme stocks (CDS's): check

iii) Market at an all time high: Check

iv) Gary Gensler is coming into clean the mess: Check

v) Banks and Hedgefunds are scrambling to get their

finances in check to prepare for the financial firestorm: Check

vi) The average person believes everything is fine:

Check

vii) Nobody is selling either meme stock, and are in

the process of doubling down (nobody sold their CDS's too, and doubled down on

synthetic CDO's): Check (https://capital.com/amc-entertainment-holdings-cl-a-share-price ,

https://capital.com/gamestop-share-price )

vi) Institutions are starting to view these stocks as insurance and are buying in: Check.

As you can see most factors for a market change are here, now lets talk about how the GME squeeze before the halts, how it may have played out, and how this created, the situation with the darkpools, similarly to when prices of the mortgage bond prices were increasing when the underlying mortgages were failing; it was artificial, like the trading halts. As such here are some screenshots, during the halts:

As you can see, without the halts GameStop would've

jump to 10k the next day, immediately forcing the shorts to cover; they didn't

do that, they went ahead and used a combo of synthetic shorting and darkpools

to tank the price and make retail apes hold the bag, however that didn’t work,

and we are at our current predicament with the darkpools.

Furthermore, if you check the margin requirements for

meme stocks:

ii) https://www.schwab.com/margin-updates

So, they're up to 300% from their usual 100%, which means their really hard to borrow, which means inevitably they will squeeze. Combine this with the darkpools as elaborated above, and the financial illegalities that have been proven in this article, you can start to comprehend the magnitude of their financial war crimes.

Now let us address the intention of institutions going long; I'll be honest, I think they're planning to wipe out their competition completely like in 2008, last time Lehman Brothers, Bear Stearns, Merrill Lynch etc. went down; this time Citadel and other market makers, while institutions that go long on these meme stocks will simply take their wiped-out competitions market share and place. This is what I'd do if I we're Blackrock or Vanguard at this point.

Now finally let us address the final point of this section and move on to a recap and how this series of DD's will play going forward. Remember that question, what if TD is not the darkpool, well; based on these 2 sources:

i) https://link.springer.com/content/pdf/bbm%3A978-1-137-44957-3%2F1.pdf

ii) https://otctransparency.finra.org/otctransparency/AtsIssueData (NMS Tier 2, January 25th moving forward (when it started))

In my speculative opinion, the TD darkpools is guaranteed not to be the only darkpool. If all darkpools that involve AMC have a synthetic share count of 4.6 bill or higher, or even the 2 bill that Citadel holds, you could see how this could blow to Olympus Mons (https://en.wikipedia.org/wiki/Olympus_Mons ). really really fast, and how screwed the shorts would be; hence the FUD.

Going forward this will be a 3 part series for AMC, and 2 part series for GME; you beautiful apes have held so far despite all this and you my friends have nothing but my highest respects, I believe your efforts will be rewarded with Martian tendies sooner rather than later.

The AMC series will consist of this article, FUD: the

desperation of shorts, AMC the climb to 10k and battle of 12008.01. The GME

series will consist of one additional article: GME, the stonk of the century.

A quick preview of FUD: the desperation of shorts, will consist of me addressing "mUh gOvErNmEnT wIlL iNtErVeNe aT 500 #trustmysourcesbro", share dilution (in my opinion will not happen, its a ploy to get the share recounts), the squeeze not happening (total FUD cause math). As DFV said, hang in there, helps on the way.

Now, let's recap these apes, I've covered a lot and I

understand it can be overwhelming but I'll try to recap it in layman's terms to

the best of my abilities. The first crucial point is they most likely owe more

than 10x float on AMC, and 13x float on GME hence they're desperate, they are

resorting to financial war crimes breaking a dozen laws trying to prevent you

from picking up your tendie orders, this happened in 2008 and in case anything

drastic happens, memestonks are your insurance and you will more than likely

have your insurance policy be exercised, all the mathematical indicators for a

squeeze are there, now its just a when, darkpools are designed to hide the

truth and hide intent, and because of those synthetic shares in these pools,

they are most likely panicking; lastly when this squeezes, you holds you apes

hold all the cards, and you, not the institutions, you determine how this

timeline and the future plays out.

---HIGH LEVEL SUMMARY---

A lot has been covered, let’s summarize. This is a repeat of 2008, but this time we hold the insurance policies, in case this moons. The similarities are quite startling, from the SEC chairman Gary Gensler coming to bust this down, them using darkpools to screw the average person out of tendies, committing financial war crimes in broad daylight to shake apes. Furthermore, the darkpools explicitly showing both meme stocks have been naked shorted by at least 10x, this squeeze is mathematically confirmed, and we are looking at a fallout, how big the fallout will be depends on how big the hole they dug themselves with these darkpools; but in any case, apes hold the insurance policies so I believe we should be chilling, and if we continue to buy and hold we are simply buying more insurance for stonks we like. As such to sum it up in one sentence, their hiding in darkpools, Gary Gensler is starting the hunt and we have the insurance policies.

---What you can look forward to in this series--

As stated above, this series will diverge into 2 hyper focused parts; one GME focused, another one AMC focused. The AMC series will be:

i) Dance of Darkness: The SEC and Darkpools

ii) FUD: the desperation of shorts

iii) AMC the climb to 10k and battle of 12008.01

GME:

i) Dance of Darkness: The SEC and Darkpools.

ii) GME, the journey too Olympus Mons.

---TLDR---

Their hiding in darkpools and using ETFs, naked shorting and synthetic shorting to manipulate the market hoping people will sell so they can exit the feedback loop as illustrated; there are most likely multiple darkpools with synthetic shares hence their desperation (+ their overleveraged). These memestocks have become swaps (CDS's: Credit Default Swaps), and those who hold them hold insurance against any financial disturbance. The longer this manipulation continues, the larger the correction will most likely be.

---Final Commentary and Thanks---

Thank you for sticking with me and going through this

rather long article, the reason why I keep this article long and extensive is

because I believe in market transparency and integrity like Gary Gensler;

furthermore I do not believe in hit pieces, I believe all the data should be on

the table and that the average person can and will be able to understand the

market, and does not need to be guided into making decisions, as I believe the

average person knows their situation best and is capable of making decisions

that most benefit them in their situation. As such, these articles moving

forward will remain long, extensive and mathematical in nature; in an effort to

bring as much transparency as possible to the marketplace.

Furthermore, I understand there is a lot of FUD floating around on meme stocks, these articles serve as papers that can be used to counter this; as they are designed to investigate the causes of why meme stocks act the way they do (the complexities of meme stocks are quite extensive as you may have noticed), thus in my believe help counter the cloud of FUD on both of these stonks.

Lastly, I usually don't do this; however, I will put in a request as we are in extraordinary times now and I believe in the average person and my fellow ape. I would ask you to share this wherever you can (my favourite is stockwits), twitter stockwits, facebook, instagram, whatsapp, etc; get the message out, I believe there are a lot of people that would benefit from the information posted; also the more feedback going here, the less of an echo chamber and the livelier this discussion becomes, allowing us to learn more about aspects of meme stonks that we may have missed in this article. Thank you in advance if you have shared this on your platforms of choice; I hope it helps a lot of apes; and as DFV, during congressional testimony, alluded to Hang in there. Here's a quick quote to encapsulate the entire article in my opinion: "You will never do anything in this world without courage. It is the greatest quality of the mind next to honor" - Aristotle. Finally, here's a quick hashtag you may use if you feel like using social media to make this article spread fast: #DanceofDarkness.

Legal Disclaimer: None of this was or is financial

advice, this is purely speculative opinion based on the sources as presented in

this article; as such this should be taken as for entertainment purposes i.e

the entertainment of ideas. Lastly, I am not a cat, and I like the stock. Thank

you for your time.

Amazing read. Thank you

ReplyDelete